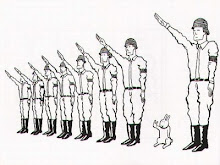

Privatize Profit, Socialize Loss

The FDIC has $51 billion in assets, but only $4.2 billion in cash. For all banks. And there are a lot of banks that are going to go bust later this year and next year and the year after that. Banks that made far worse loans than even IndyMac. Banks that have have more regular insured accounts -- never mind the shortfalls! -- than the entire budget of the FDICasparagirl comment on Metafilter

Banks that have more depositors and assets and liabilities than anything the FDIC has ever had to deal with before.

You want names? Busted banks that are very likely coming soon: Downey Savings and Loan (DSL), National City (NCC), BankUnited (BKUNA), First Federal (FED), Corus (CORS). After that come the big boys: Washington Mutual (WM), Wachovia (WB - used to be WorldBank). And that's when the real fun starts...

When the FDIC starts to sell off IndyMac's piece of shit mortgages assets, it thereby be defining what the market price is for those items, because it will be finding out what an actual sale price is on them. That means that every other bank or financial institution that has had similar assets tucked away off their balance sheets in magical "Level 3" land (i.e. "there's no easy way to define what the price for these assets are because there's currently no market for them, so their price is what we say it is") suddenly has to bring those assets back onto their balance sheets, and do so at their new fire sale price.

And this is what Ralph Nader had to say in his July 1 column:

Top management on Wall Street has been beyond incompetent. Wild risk taking camouflaged for years by multi-tiered, complex, abstract financial instruments (generally called collateralized debt obligations) kept the joy ride going and going until the massive financial hot air balloon started plummeting. Finally told to leave their high posts, the CEOs of Merrill-Lynch and Citigroup took away tens of millions of severance pay while Wall Street turned into Layoff Street.

The banks, investment banks and brokerage firms have tanked to levels not seen since the 1929-30 collapse of the stock market. Citigroup, once valued at over $50 per share is now under $17 a share.

Washington Mutual – the nation’s largest savings bank chain was over $40 a share in 2007. Its reckless speculative binge has driven it down under $5 a share. Yet its CEO Kerry Killinger remains in charge, with the continuing support of his rubberstamp Board of Directors. A recent $8 billion infusion of private capital gave a sweetheart deal to these new investors at the excessive expense of the shareholders.

Countrywide, the infamous giant mortgage lender (subprime mortgages) is about to be taken over by Bank of America. Its CEO is taking away a reduced but still very generous compensation deal.

Meanwhile, all these banks and brokerage houses’ investment analysts are busy downgrading each others’ stock prospects.

Over at the multi-trillion dollar companies Fannie Mae and Freddie Mac, the shareholders have lost about 75 percent of their stock value in one year. Farcically regulated by the Department of Housing and Urban Affairs, Fannie and Freddie were run into the ground by taking on very shaky mortgages under the command of CEOs and their top executives who paid themselves enormous sums.

These two institutions were set up many years ago to provide liquidity in the housing and loan markets and thereby expand home ownership especially among lower income families. Instead, they turned themselves into casinos, taking advantage of an implied U.S. government guarantee.

The Fannie and Freddie bosses created another guarantee. They hired top appointees from both Republican and Democratic Administrations (such as Deputy Attorney General Jamie Gorelick) and lathered them with tens of millions of dollars in executive compensation. In this way, they kept federal supervision at a minimum and held off efforts in Congress to toughen regulation. These executives are all gone now, enjoying their maharajan riches with impunity while pensions and mutual funds lose and lose and lose with no end in sight, short of a government-taxpayer bailout.

Over a year ago, leading financial analyst Henry Kaufman and very few others warned about “undisciplined” (read unregulated) and “mis-pricing” of lower quality assets. Mr. Kaufman wrote in the Wall Street Journal of August 15, 2007 that “If some institutions are really ‘too big to fail,’ then other means of discipline will have to be found.”

There are ways to prevent such crashes. In the nineteen thirties, President Franklin Delano Roosevelt chose stronger regulation, creating the Securities and Exchange Commission (SEC) and several bank regulatory agencies. He saved the badly listing capitalist ship.

Today, there is no real momentum in a frozen Washington, D.C. to bring regulation up to date. To the contrary, in 1999, Congress led by Senator McCain’s Advisor, former Senator Phil Gramm and the Clinton Administration led by Robert Rubin, Secretary of the Treasury, and soon to join Citibank, de-regulated and ended the wall between investment banks and commercial banking known as the Glass-Steagall Act.

Clinton and Congress opened the floodgates to rampant speculation without even requiring necessary and timely disclosures for the benefit of institutional and individual investors.

Now the entire U.S. economy is at risk. The domino theory is getting less theoretical daily. Without investors obtaining more legal authority as owners over their out of control company officers and Boards of Directors, and without strong regulation, corporate capitalism cannot be saved from its toxic combination of endless greed and maximum power—without responsibility.

Uncle Sam, the deeply deficit ridden bailout man, may have another taxpayers-to-the-rescue operation for Wall Street. But don’t count on stretching the American dollar much more without devastating consequences to and from global financial markets in full panic.

4 Comments:

At 5:23 AM, Anonymous said…

Anonymous said…

Re: Watford City. The only way to make money these days is to deal in drugs or oil or both.

At 8:54 AM, Anonymous said…

Anonymous said…

I don't understand why everyone is freaking out so bad. If you lose money in Vegas you just take your lumps. No one blames the dealer or the pretty girl serving drinks. If you play the market you are flat ass gambling. Get a life.

At 12:45 PM, Flimsy Sanity said…

Flimsy Sanity said…

Stevo: Putting money into a bank was supposed to be the opposite of gambling on wall street - little did we know the bankers were doing the gambling.

At 8:09 AM, ryk said…

ryk said…

If you play the market you are flat ass gambling. Get a life.

You need to get a clue, Stevo. This is not about investors and shareholders taking losses. It's about taxpayers having to shoulder the burden of covering those losses to try to save what's left of our economy.

Post a Comment

<< Home