Found while browsing

There's a particular moment known to all Baby Boomers when Wile E. Coyote, in a rapture of over-reaching, has run past the edge of the mesa and, still licking his chops and rubbing his front paws in anticipation of fricasseed roadrunner, discovers that he is suspended in thin air by nothing more than momentum. Grin becomes chagrin. He turns a nauseating shade of green, and drops, whistling, back to earth thousands of feet below, with a distant, dismal, barely audible thud at the end of his journey. We are Wile E. Coyote Nation.

Is there anyone in the known universe who thinks that the US financial system is not fifty feet beyond the edge of the mesa of credibility?

Nothing will avail now. Not even if Sirhan Sirhan were paroled at noon today and transported directly to the West Wing with a .44 magnum in each hand (and a taxi driven by the Devil waiting outside to take him to the US Treasury and the offices of the Federal Reserve).

It's hard to imagine what kind of melodramas were unspooling on the Hamptons lawns this weekend, while everybody else in America was watching Nascar, or plying the aisles of BJs Discount Warehouse for next week's supply of mesquite-and-guacamole flavored Doritos, or having flames and chains tattooed on their necks, or lost in a haze of valium and methadrine.

With the death of the IndyMac Bank last week, and the GSEs Fannie Mae and Freddie Mac laying side-by-side in the EMT van on IV drips, headed for the Federal Reserve's ever more crowded intensive care unit, there was a sense of the American Dream having passed through the event horizon that denotes the opening of a black hole.

What would happen if the US Government acted to bail out these feckless enterprises (and what if they don't)? Either way, it's not a pretty picture. If Mr. Bernanke does start shoveling loans into the GSE black hole, he'll further undermine the soundness of his own outfit and do nothing, really, to repair Fannie and Freddie's structural problem of having securitized too many loans that will never be paid back. If instead Fannie and Freddie are flat-out taken over entirely by the US government (and remember the Federal Reserve is not the government), then the national debt will roughly double overnight -- which will pound the US dollar down a rat-hole.

Meanwhile, the foreign holders of those decrepitating dollars might not rush to the redemption window, but they certainly would use them to buy up every oil futures contract on God's not-so-green Earth as fast as possible -- they'd be dumb not to -- which would leave American Happy Motorists with gasoline prices north of $5 a gallon, and possibly north of $10. (In that case, say goodbye to the airlines. In fact, say goodbye to what passes for the rest of the US economy, including especially the vaunted retail sector that supposedly counts for 70 percent of the action.)

If Fannie and Freddie are left to die out on the desert floor, say goodbye to the housing market, the major investment banks, countless regional banks, the retirement accounts of virtually everyone in America, the viability of all fifty states' governments, and the day-to-day operating ability of all their municipalities -- and very likely the current incarnation of the world banking system.

This process is really out of control now. The bottom line is the comprehensive bankruptcy of the United States. The Republican Party under George Bush will be known as the party that wrecked America (release 2.0). Painful as it is, Americans had better get a new "Dream" and fast. It better be a dream based on the way the universe actually works, which is to say an operating procedure run on earnest effort and truthfulness rather than merely trying to get something for nothing and wishing on stars. We might begin symbolically by evacuating Las Vegas and calling in an air strike on the loathsome place -- to register our new reality-based attitude adjustment.

After that, we've got to get to work re-tooling all the everyday activities of life, including the way we grow our food, the way we raise and deploy capital, the way we do trade and manufacturing, the way we go from point A to point B, the way we educate children, the way we stay healthy, and the way we occupy the landscape. I know, it sounds like a lot, maybe too much. But grok this: we don't have any choice if we want a plausible future on this portion of the North American continent.

Of course, none of that is likely to happen. Instead, and under the worst imaginable economic conditions, we'll probably embark on a campaign to prop up the un-prop-up-able and sustain the unsustainable -- that is, defend every status quo habit and behavior that we're used to, whether it can be salvaged or not. Of course, this would be a fatal squandering of our dwindling resources, but it it tends, historically, to be the last act of the melodrama in any faltering empire.

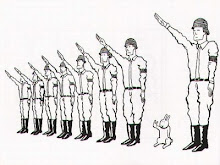

The result, pretty soon into that process, will be social breakdown and political upheaval. Every tattoo freak out there who has been prepping for his own starring role in some kind of comic book armageddon will finally get his chance to shine. Lots of people will get hurt and starve. Property will change hands in a disorderly way. And at the end of this process an American corn-pone Hitler may be waiting to set everything and everyone straight.

Event Horizon by James Howard Kunstler

He also wrote this interesting take on the real oil speculators:

One consequence is that other nations sitting on our exported dollars (from our massive trade deficit) have apparently decided to spend off those dollars rather than wait for the fullblown financial collapse of the nation issuing them. My guess is that they are spending those dollars on oil, the primary resource of industrial economies, and that they are prepared to outbid other contestants (including the USA) no matter what -- because they know the dollar is losing value, and that those losses are apt to accelerate over time, and what else would they spend them on? I suspect this is behind the rising price of oil more than anything else.

Republicans spout the gospel that there is plenty of shale oil (in addition to the arctic oil, of course). This says they are nuts:

The production of oil from oil shale has been attempted at various times for nearly 100 years. So far, no venture has proved successful. One problem is that there is no oil in oil shale. It is a material called kerogen. The shale has to be mined, transported, heated to about 900 degrees F, and have hydrogen added to the kerogen to make it flow. The shale pops like popcorn when heated so the resulting volume of shale after the kerogen is taken out is larger than when it was first mined. The disposal problem is large. Net energy recovery would be low at best. It also takes several barrels of water to produce one barrel of oil. The largest shale oil deposits in the world are in the Colorado Plateau, a markedly water poor region. So far shale oil is, as the saying goes: "The fuel of the future and always will be." Fleay (1995) states: "Shale oil is like a mirage that retreats as it is approached." Shale oil will not replace oil.Walter Youngquist, Consulting Geologist, Eugene, OR.USA.

1 Comments:

At 8:28 PM, Anonymous said…

Anonymous said…

A great piece of writing by Kunstler - and probably accurate.

Post a Comment

<< Home