The Shrinking Middle Class

President Bush has expanded the federal budget by 30 percent. Republicans

expand the government much more than Democrats do. If you look at the Reagan

administration, the Nixon administration, both Bush administrations, they’re all

big government operation. The smallest government guy in recent times was Jimmy Carter. Even Clinton was a smaller government guy than George Bush.” Bill Moyers

NOW program interviewing Lew Rockwell, conservative libertarian.

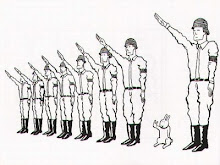

It is not big government per se they want to strangle, but social programs like health, education, social security and social welfare. Despite their self-identification as the party of entrepreneurial, competitive small business, the Bush crowd has shown itself to be a relentless advocate for non-entrepreneurial, competition-averse large businesses. They expand monies for military and corporate welfare but instead of paying for it, they increase the national debt. Everything favorable to production like cheap labor and cheap raw products like grain or oil are to be controlled at government expense for the benefit of large businesses.

The Republicans repeat the dogma that free enterprise will keep this country great. The famous writer (and observer of common Americans who wrote the classic Working) Studs Terkel says, “We have national Alzheimer’s disease.” He says that when the stock market crashed in 1929 (due to “free market economics”) nearly everyone was knocked down. It was the New Deal and all of its regulatory agencies that saved Americans from being cold, jobless and hungry. It was the New Deal and programs like the GI bill that gave us a middle class of blue-collar manufacturing workers and professionals that could own a home, educate their children through college, own a car and consume on a grand scale. Now, the children and grandchildren of the people that “big government” saved, including our President, use that phrase as if it is a dirty word. Free enterprise and global trading are the shimmering waters that will raise all boats. The 1920’s, with every idiot investing in the stock market and no one with a savings accounts is being repeated with a vengeance. Everyone with a 401K feels they are in the driver’s seat, ignoring the fact that all investments can be risky and they have absolutely no market control. People have bought the fable that the corporations do the things they do because they are concerned about the personal investor. People feel they can become rich through the market and although it occasionally happens and a little trickles down to the individual investor, it is also very possible their investments will disappear in a poof of malfeasance.

It is another common fable that, in America, you can become rich if you work hard. I personally know of four people who are rich. One inherited it, one got there through hard work and aggressively buying up all the land he could and the other two are accidentally rich because oil was found on their land. Most white people I know who work hard can still afford a house, but it has a mortgage on it. They cannot afford to send their children to college without loans or government aid. They make payments on their cars. Most Mexican people who work really hard on farms and butchering facilities in the US can afford few of these benefits nor can their brethren factory workers south of the border. Chinese factory workers who work really, really hard can afford maybe food and poor shelter.

I just read an article that I recommend highly. Paul Krugman explains in very simple language how and why the middle class is disappearing.

The following was an interesting observation, I thought. In a Slate article, Soren Nilsson attributes the decline of Sears to the shrinking middle class:

Fifty years ago, American consumers fell into three general categories: high-,

middle- and low-end shoppers. The low ender shopped at various discount stores

(before the ubiquitous Wal Mart empire.) High enders shopped at Saks, Neiman

Marcus and Bloomingdales. The middle class went to Sears and Montgomery Ward.Now

the middle market consumers are being squeezed by stagnant wages and increased

costs for largely non-discretionary items, such as home heating, food and health

insurance. Increasingly, they are turning to Wal Mart and others discount

outlets to stretch their dollars…