The Love of Money

Perhaps 60% of today’s oil price is pure speculation’ by F. William Engdahl

The price of crude oil today is not made according to any traditional relation of supply to demand. It’s controlled by an elaborate financial market system as well as by the four major Anglo-American oil companies. As much as 60% of today’s crude oil price is pure speculation driven by large trader banks and hedge funds. It has nothing to do with the convenient myths of Peak Oil. It has to do with control of oil and its price.

In June 2006, oil traded in futures markets at some $60 a barrel and the Senate investigation estimated that some $25 of that was due to pure financial speculation. One analyst estimated in August 2005 that US oil inventory levels suggested WTI crude prices should be around $25 a barrel, and not $60.

That would mean today that at least $50 to $60 or more of today’s $115 a barrel price is due to pure hedge fund and financial institution speculation. However, given the unchanged equilibrium in global oil supply and demand over recent months amid the explosive rise in oil futures prices traded on Nymex and ICE exchanges in New York and London it is more likely that as much as 60% of the today oil price is pure speculation. No one knows officially except the tiny handful of energy trading banks in New York and London and they certainly aren’t talking.

By purchasing large numbers of futures contracts, and thereby pushing up futures

prices to even higher levels than current prices, speculators have provided a financial incentive for oil companies to buy even more oil and place it in storage. A refiner will purchase extra oil today, even if it costs $115 per barrel, if the futures price is even higher.

As a result, over the past two years crude oil inventories have been steadily growing, resulting in US crude oil inventories that are now higher than at any time in the previous eight years. The large influx of speculative investment into oil futures has led to a situation where we have both high supplies of crude oil and high crude oil prices.

Compelling evidence also suggests that the oft-cited geopolitical, economic, and natural factors do not explain the recent rise in energy prices can be seen in the actual data on crude oil supply and demand. Although demand has significantly increased over the past few years, so have supplies.

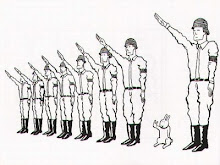

Please read the whole article. I would guess we could see a similar scenerio with food as speculation runs rampant in the commodities market. We all think that if we can play the market, we don't need a production society but instead we can be an ownership society and live off the labor of others. A jerk I knew in the coin trade who was always happy when war would break out in the world because the price of gold (and along with it, collectible coins) would go up.

Karl Menninger in his book, Whatever Became of Sin said, "If a group of people can be made to share the responsibility for what would be a sin if an individual did it, the load of guilt rapidly lifts from the shoulders of all concerned. Others may accuse, but the guilt shared by the many evaporates for the individual. Time passes. Memories fade. Perhaps there is a record, somewhere, but who reads it?"

1 Comments:

At 5:55 AM, Anonymous said…

Anonymous said…

Also on that same site is this article about Iran dumping the dollar.

Post a Comment

<< Home