Home Investments

Foreclosures are at a record high. Home equity is at a record low. The housing market is spiraling down with no end in sight -- and taking people's sense of economic security with it. For the first time since the Federal Reserve started tracking the data in 1945, the amount of debt tied up in American homes now exceeds the equity homeowners have built. Economy.com estimates 8.8 million homeowners, or about 10 percent of homes, will have zero or negative equity by the end of the month. Even more disturbing, about 13.8 million households will be "upside down" if prices fall 20 percent from their peak. The latest Standard & Poor's/Case-Shiller index showed U.S. home prices plunging 8.9 percent in the final quarter of 2007 compared with a year earlier- http://biz.yahoo.com/ap/080306/housing_woes.html

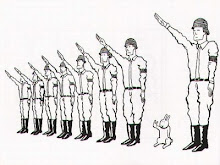

We have gone through the tech com bubble, the housing bubble, the only thing left is the military armaments bubble, but really, how many wars can we have?

0 Comments:

Post a Comment

<< Home