4 Years Ago before the housing crisis

by John Finger

The Money Management Firm, Inc.

March 11, 2003

The First Signs Are Already Here

The most noticeable sign is in unemployment. Sure, the official unemployment rate is low as of the time of this writing (5.7%), but the standard used to measure unemployment is seriously flawed. For example, that standard does not include “discouraged” workers; that is, those who have given up looking for work. It also doesn’t include the “underemployed,” who are highly trained but can’t find jobs in their own fields, leaving them to work in jobs for which they are overqualified and underpaid. Additionally, the Labor Department publishes new claims for unemployment benefits on a weekly basis. Economists consider anything less than 400,000 new claims a sign of a recovering economy. Yet 400,000 seems to be an average. With that many new claims each week and the help-wanted index hovering near 30-year lows, we can see that the official unemployment rate, regardless of the number, grossly understates the true percentage of unemployed.

People choose to bury their heads in the sand and ignore stock market history. Even if the stock market is boring to you, you must understand one cold, hard fact: the stock market leads the economy. The economy was roaring along when the stock market topped out in both September 1929 and March 2000. When the market started declining, the economy soon followed. In the spring of 1930, people thought that the worst was over: the DJIA recovered to nearly 300 as the economy showed signs of improvement. But then the DJIA took a hard turn south, dragging the economy down shortly thereafter. The DJIA had five major bear market rallies before it bottomed in 1932. So far in this bear market, we have had four rallies, each leading to newer lows.

The stock market has likewise led the economy into other weak periods. Cases in point were bear markets in 1962, 1973-1974 and 1980-1982.

Individual players in the stock market will lie through their teeth, because they have a position to support. But the stock market itself never lies.

We’re seeing deflation for the first time since the 1930s. That’s right: downright deflation. Look at the list compiled by Comstock partners: PCs and peripherals; butter; TVs; toys; long-distance charges; used cars and trucks; audio equipment; women’s underwear, nightwear, sportswear and accessories; milk; men’s pants and shorts; pork chops; airline fares; new cars; electricity; ship fares; and kitchen, living room and dining room furniture. In most areas of the country, housing prices have started to drop. Rents are dropping. “For Rent” or “For Sale” signs appear at nearly every office building we look at, whether it’s here in Colorado, San Francisco, or anywhere. There are very few prospective tenants who are shopping for space. In fact, the only area where any inflation still exists is in health insurance and energy costs.

The Federal Reserve Board is obviously concerned about deflation. In November 2002, Federal Reserve Board Governor Ben Bernanke made a now-infamous speech to a group of economists in Washington on his version of a remedy for deflation. Bernanke is quoted as saying:

"The U.S. government has a technology, called a printing press - or today, its electronic equivalent

- that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

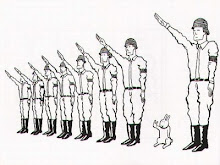

He was right, but his comments led investors to sell dollars and buy Euros and gold. Moreover, Mr. Bernanke forgot one minor detail: Germany, faced with huge deficits caused by reparations requirements after World War I, tried the same thing in the 1920’s. Pictures soon appeared worldwide, showing people with wheelbarrows full of Reichmarks lining up to buy a loaf of bread. The country was still in a Depression, despite the printing presses having worked overtime. This led in large part to the rise of Adolf Hitler.

What else can the Fed do? They have already knocked the Fed Funds rate from 6% to 1.25%, the lowest rate since 1962, and it hasn’t worked. Japan has knocked short-term rates down to 0.25%, and that country has been in a deep slump for most of the last 11 years. But we’ll be lucky if we go down Japan’s road: at least Japan is a country of savers. We are a country of spenders.

People tend to not care about the trade deficit since they don’t see it. But it’s huge and getting worse. Moreover, when the last Great Depression started, the United States was the world’s largest creditor. Now, we’re the world’s largest debtor nation. In 2002, our trade deficit hit a record $435 billion, and we’re currently borrowing about $10 billion per week. For economists, the trade deficit is now 5% of GDP, a huge amount. All of this occurs despite a weaker dollar. The United States buys goods that are made overseas, because countries like China, India and Mexico have far cheaper labor costs than we do. When we buy their products, our dollars leave our shores and go to the sellers. The sellers have to do something with those dollars. Until recently, those sellers would typically repatriate the money by buying American stocks and bonds. Now, however, with declining stocks, low bond yields, lowering real estate prices and a falling dollar, those expatriate dollars have nowhere to go in America. Think about it: if you have a large amount of dollars, where would you put them right now? Foreigners have that same problem. Since they’re not investing here, investment in our infrastructure declines, which weakens our economic picture even more.

6 Comments:

At 12:29 PM, Jennifer Briney said…

Jennifer Briney said…

This was written 3 years ago? My God - we're in so much trouble.

In September of last year I took some money and put it into Euros. I have since then "made" over $765 because of the 10 cent decline in the dollar since then.

What's going to happen when whole countries do what I have done and transfer their savings to a better and more stable currency? What is going to happen to us here?

More importantly - how do we stop it?

At 6:52 PM, Anonymous said…

Anonymous said…

More importantly, what will happen if the petro-dollar is displaced by the petro-euro?

At 8:40 PM, Anonymous said…

Anonymous said…

Hi!

play stock? i want to study stock this year, and next year , i may buy some。We study together !

At 7:16 AM, Flimsy Sanity said…

Flimsy Sanity said…

Jen: Maybe the Mormons have the right idea about storing food.

RJ:There is no reason why our dollar is worth what it is now. I read that Cheney has moved over 25% of his millions already.

At 12:01 PM, Anonymous said…

Anonymous said…

From Wolf Laurel in NC mountains – The housing recession is negatively impacting property sales in second home communities in Florida as well as slowing sales in NC mountain resorts that depend on Florida buyers.

Still the downturn in prices and building of inventories is starting to attract second home buyers from Florida looking for cool temperatures in our mountains. Also the dramatic decline in the dollar combined with weakness in American real estate markets are beginning to interest some bargain hunting European investors.

Ron Holland, Broker/Realtor with Wolf's Crossing Realty. Ron markets resale mountain and ski resort properties in Wolf Laurel and The Preserve at Wolf Laurel. The credit crisis and housing meltdown offers serious risks but also some opportunities to Americans. He has a free report on the crisis entitled “From Real Estate Bubble To Buyers Market”. See www.ronaldholland.com for more details.

At 6:34 AM, ryk said…

ryk said…

I think at least part of dubya's true justification for invading Iraq was to prevent Saddam from switching to the Euro as payment for Iraqi oil. We support the monarchy in Saudi Arabia for the same reason.

Post a Comment

<< Home