Economics Lesson

During the Depression that preceded World War II, the English economist John Maynard Keynes, a liberal capitalist, proposed a form of governance that would mitigate the boom-and-bust cycles inherent in capitalist economies. To prevent the economy from contracting, a development typically accompanied by social unrest, Keynes thought the government should take on debt in order to put people back to work. Some of these deficit-financed government jobs might be socially useful, but Keynes was not averse to creating make-work tasks if necessary. During periods of prosperity, the government would cut spending and rebuild the treasury. Such countercyclical planning was called “pump-priming.”

Upon taking office in 1933, U.S. President Franklin Roosevelt, with the assistance of Congress, put several Keynesian measures into effect, including socialized retirement plans, minimum wages for all workers, and government-financed jobs on massive projects, including the Triborough Bridge in New York City, the Grand Coulee Dam in Washington, and the Tennessee Valley Authority, a flood-control and electric-power-generation complex covering seven states. Conservative capitalists feared that this degree of government intervention would delegitimate capitalism – which they understood as an economic system of quasi-natural laws – and shift the balance of power from the capitalist class to the working class and its unions. For these reasons, establishment figures tried to hold back countercyclical spending.

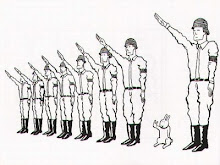

The onset of World War II, however, made possible a significantly modified form of state socialism. The exiled Polish economist Michal Kalecki attributed Germany’s success in overcoming the global Depression to a phenomenon that has come to be known as “military Keynesianism.” Government spending on arms increased manufacturing and also had a multiplier effect on general consumer spending by raising worker incomes. Both of these points are in accordance with general Keynesian doctrine. In addition, the enlargement of standing armies absorbed many workers, often young males with few skills and less education. The military thus becomes an employer of last resort, like Roosevelt’s Civilian Conservation Corps, but on a much larger scale.

The prosperity of the United States came increasingly to depend upon the construction and continual maintenance of a vast war machine, and so military supremacy and economic security became increasingly intertwined in the minds of voters. No one wanted to turn off the pump.

Even when all these things are included, Enron-style accounting makes it hard to obtain an accurate understanding of U.S. dependency on military spending. In 2005, the Government Accountability Office reported to Congress that “neither DOD nor Congress can reliably know how much the war is costing” or “details on how the appropriated funds are being spent.” Indeed, the GAO found that, lacking a reliable method for tracking military costs, the Army had taken to simply inserting into its accounts figures that matched the available budget. Such actions seem absurd in terms of military logic. But they are perfectly logical responses to the requirements of military Keynesianism, which places its emphasis not on the demand for defense but rather on the available supply of money.

The more likely check on presidential power, and on U.S. military ambition, will be the economic failure that is the inevitable consequence of military Keynesianism. Traditional Keynesianism is a stable two-part system composed of deficit spending in bad times and debt payment in good times. Military Keynesianism is an unstable one-part system. With no political check, debt accrues until it reaches a crisis point.

The other big employer is the prison industry. The U.S. incarceration rate of 750 adults per 100,000 population is the world's highest. The average rate globally is 166 per 100,000 persons.

3 Comments:

At 3:34 PM, ryk said…

ryk said…

This guy scares the hell out of me because everything he says sounds so logical to me, and he's predicting some very bad times ahead.

At 5:09 AM, Unknown said…

Unknown said…

Indeed, speaking of prophecy, he published the first book of his trilogy, Blowback, in 2000, which predicted a 9-11 type event due to our egregious foreign policies of the last 50 years.

At 5:13 PM, Anonymous said…

Anonymous said…

Don't forget the institute of female incarceration... otherwise known as the insane asylum, where perfectly rational but objectionable women can have their rights taken away and be experimented on without impunity to their captors, or even with a hope of release for the unhappy prisoners.

anan

Post a Comment

<< Home