Free Market Follies

Markets are dropping all over the world. An interesting article about the banker's guilt is Will the Big Banks Collapse Here is just a portion of an interesting synopsis:

Through a complex combination of government-licensed monopoly (Federal Reserve System), implied government safety nets for mortgage investors (Fannie Mae and Freddy Mac), creative finance (asset-backed securities), and credit-rating services that were either stunningly naive or compensated in ways not beneficial to objective analysis, brokers marketed a series of high-commission, fast-sale investment packages that sold like hotcakes until August, 2007. Then, without warning, they stopped selling.

These packages had sold all over the world. European banks got in on the action, marketing these investment packages to their clients.

Americans have seen all this before: the savings and loan crisis of the 1980's. The S&L's were borrowed short (depositors) and lent long (home buyers). Then the rules changed. The government in 1980 abolished Regulation Q, which had limited the rate of interest that banks and S&L's could pay to depositors. A rate war began.

That was the test of the mortgage carry trade. The system failed. We are now in the midst of another similar test. It is much larger. It is worldwide. It is affecting capital markets that were once far-removed from mortgages.

You have heard of NINJA loans: no income, no job or assets. These were loans made by local mortgage brokers to first-time home buyers. Poor people were offered loans at rates far lower than conventional loans. The brokers told the prospective debtors that they could re-finance later to get long-term loans. This was not put in writing, and so it cannot be proven. But everyone in the industry knew it was being done. Therein lies the trap for America's largest banks. "Everyone knew."

The ticking time bomb in the U.S. banking system is not resetting subprime mortgage rates. The real problem is the contractual ability of investors in mortgage bonds to require banks to buy back the loans at face value if there was fraud in the origination process.

And, to be sure, fraud is everywhere. It's in the loan application documents, and it's in the appraisals. There are e-mails and memos floating around showing that many people in banks, investment banks and appraisal companies - all the way up to senior management - knew about it.

That is the supposed key to the prosecution: "Everyone knew." If everyone knew, then defrauded investors have a legal case. Anyway, they would have a case if they were not trying to collect from the real masters of America, the multinational banks.

When a criminal conspiracy acts in a criminal fashion, it can be prosecuted. But when a criminal conspiracy has been licensed by the government, and has de facto run the government of every major nation for a century, it will be difficult to get a conviction. None dare call it criminal.

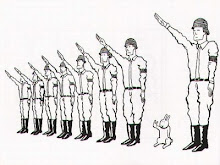

In both cases, we had free market cheerleaders for Presidents. And both believed in government intervention when their suit and tie fraudsters wrecked. Where is the philosophy that the free market will solve all problems? Of course, these law and order authoritarian freaks think that it is only the peasants that need policing. They might have to release all the drug users who never harmed anyone to make room for the liars and cheats who can watch time creep on their Rolex's.

I once read an article on the depression years and the author said that in the wild 20's, absolutely everyone put their money into the stock market, even the shoeshine boys. Seems we never learn that the big boys are not our friends.

1 Comments:

At 7:03 PM, Anonymous said…

Anonymous said…

They're certainly not our friends. All they want is our last dime. Of course, when they get it, consumerism dries up and they suffer. Greed has to tread a fine line, one that is frequently crossed, with results such as we are seeing today.

Post a Comment

<< Home