Money Versus Wealth

Great article, I suggest you read it all.

The problem is this: a predatory global financial system, driven by the single imperative of making ever more money for those who already have lots of it, is rapidly depleting the real capital the human, social, natural, and even physical capital on which our well-being depends.

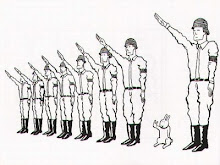

The truly troubling part is that so many of us have become willing accomplices to what is best described as a war of money against life. It starts, in part, from our failure to recognize that money is not wealth. Wealth is something that has real value in meeting our needs and fulfilling our wants. Modern money is only a number on a piece of paper or an electronic trace in a computer that by social convention gives its holder a claim on real wealth. In our confusion we concentrate on the money to the neglect of those things that actually sustain a good life.

It is striking how difficult our very language makes it to express the critical difference between money and real wealth. Picture yourself alone on a desert island with nothing to sustain yourself but a large trunk filled with bundles of hundred dollar bills. The point becomes immediately clear.

Think of a modern money economy as comprised of two related subsystems. One creates wealth. It consists of factories, homes, farms, stores, transportation and communications facilities, the natural productive systems of the planet, and people going to work in factories, hospitals, schools, stores, restaurants, publishing houses, and elsewhere to produce the goods and services that sustain us. The other creates and distributes money as a convenient mechanism for allocating wealth. In a healthy economy the money system serves as dutiful servant of wealth creation, allocating real capital to productive investment and rewarding those who do productive work in relation to their contribution.

Albania recently suffered a national crisis brought on by the collapse of fraudulent pyramid schemes. Westerners wise in the ways of the market were bemused by the naiveté of the Albanians who fell for "investment" schemes promising returns as high as 25 percent a month with no real business activity behind them. During the course of the nationwide speculative frenzy, farmers sold their flocks and urban dwellers their apartments to share in the promised bonanza of effortless wealth. The inevitable collapse sparked widespread riots, arson, and looting when the Albanian government failed to make up the losses.

Those inclined to laugh at the innocence of the Albanians should first consider their own response to proposals that social security contributions be invested in a stock market that even Federal Reserve Chairman Alan Greenspan says is substantially over valued. The speculative financial bubble, which involves bidding up the price of an asset far beyond its underlying value, is little more than a sophisticated variant of the classic pyramid scam.

Investing in a bubble is a form of gambling and it isn't entirely naive. Who cares if there is nothing behind it? The bubble is the action. The trick is to place big bets and get out before it bursts. It is a game of nerves. The action gets especially exciting when banks are willing to accept the inflated assets as collateral and lend new money into existence to stake further play, which pushes prices ever higher. This process of borrowing into bubbles with newly created money is key to making financial wealth increase faster than real wealth. Furthermore, when a leveraged bubble bursts and banks are left with substantial portfolios of uncollectible loans, governments are almost forced to step in with a bailout to stop a banking collapse as the US government did in the case of the Great Depression and the more recent Savings and Loan crisis. This amounts to another money transfer, this time from taxpayers to those with money.

Money versus Wealth by David C Korten

Dr. David C. Korten has over thirty-five years of experience in preeminent business, academic, and international development institutions as well as in contemporary citizen action organizations. Trained in economics, organization theory, and business strategy with M.B.A. and Ph. D. degrees from the Stanford University Graduate School of Business, his early career was devoted to setting up business schools in low income countries — starting with Ethiopia while still a doctoral candidate at Stanford — in the hope that creating a new class of professional business entrepreneurs would be the key to ending global poverty.

0 Comments:

Post a Comment

<< Home