Economics of Innocent Fraud by J.K. Galbraith

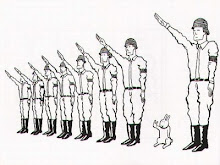

The problem is that work is a radically different experience for different people. For many - and this is the common circumstance - it is compelled by the most basic command of life: It is what human beings must do, even suffer, to have a livelihood and its diverse components. It provides life's enjoyments and against its grave discomforts or something worse. Though often repetitive, exhausting, without any mental challenge, it is endured to have the necessities and some of the pleasures of living. Also a certain community repute. Enjoyment of life comes when working hours or the workweek is over. Then and then only is there escape from fatigue, boredom, the discipline of the machine, that of the workplace generally or of the managerial authority. It is frequently said that work is enjoyed; that common assertion is mostly applied to the feelings of others. The good worker is much celebrated; the celebration comes extensively from those who have escaped similar exertion, who are safely above the physical effort.

Here is the paradox. The word 'work' embraces equally those for whom it is exhausting, boring, disagreeable, and those for whom it is a clear pleasure with no sense of the obligatory. There may be a satisfactory feeling of personal importance or the acknowledged superiority of having others under one's command. 'Work' describes both what is compelled and what is the source of the prestige and pay that others seek ardently and enjoy. Already fraud is evident in having the same word for both circumstances.

But that is not all. Those who most enjoy work - and this should be emphasised - are all but universally the best paid. This is accepted. Low wage scales are for those in repetitive, tedious, painful toil. Those who least need compensation for their effort, could best survive without it, are paid the most. The wages, or more precisely their salaries, bonuses and stock options, are the most munificent at the top, where work is a pleasure. This evokes no seriously adverse response. Nor until recently did the inflated compensation and extensive perquisites of functional or nonfunctional executives lead to critical comment. That the most generous pay should be for those most enjoying their work has been fully accepted.

A synopsis from an Amazon review:

The "innocent" frauds that Galbraith calls to our attention are actually not all that innocent. What he means by "innocent" is that for the perpetrators, there is "no sense of guilt or responsibility" as though the fraudulent were children. Indeed from the perspective of Professor Galbraith's extensive experience and learning, many of the people who run our economies and our political systems are children. At any rate, there is a somewhat lofty and even grandfatherly tone to this treatise.

The first "fraud" is the use of the euphemistic "market economy" instead of the slightly stained "capitalism" to describe the present economic system. (By the way, Galbraith does not number his frauds. I do it for the sake of keeping them straight in my mind.)

The second is the fact that in the modern corporation, ownership--that is, the stockholders--have little to no authority while the professional managers call all the shots including setting their own compensation (fraud #7). Galbraith attributes this to the fact that corporations have become so vast and complex that the relatively unsophisticated ownership cannot really understand how to run the enterprise and so must yield to management.

Fraud number three is one that interests me a lot. Galbraith writes, "Reference to the market system as a benign alternative to capitalism is a bland, meaningless disguise of the deeper corporate reality--of producer power extending to influence over, even control of, consumer demand." (p. 7) This really is one of the most pressing problems of our time because the corporate power, through its ability to influence and control its legions of employees and the media, also has "influence over, even control of" who runs for office and who is elected in national and state governments. Indeed, in fraud #8 Galbraith notes that "A large, vital and expanding part of what is called the public sector is for all practical effect in the private sector." (p. 34) He specifically identifies the "defense" industry as being largely controlled by defense contractors in the private sector. Elsewhere in the essay, Galbraith refers to "the control of consumer choice and sovereignty" indicating that he understands that the control extends to the electorate. (p. 13)

Fraud number four is the way we hypocritically value "work." For some it is toil and for others it is a pleasure and indeed largely the reason for living, and yet how differently we are compensated, with those who need it least often getting the most in financial reward.

Fraud five refers to the corporate bureaucracy. While corporate people sneer at government agencies as being bureaucratic, large corporations have become just as bloated or even more so. (Chapter V: "The Corporation as Bureaucracy.")

Fraud #6 is the phony celebration of small businesses and family farms in the political rhetoric. Galbraith comments, "For the small retailer, Wal-Mart awaits. For the family farm, there are the massive grain and fruit enterprise and the modern large-scale meat producer." (p. 25)

Fraud #9 (I've mentioned numbers 7 and 8 above) is the fraud of economic predictions. Galbraith observes: "The financial world sustains a large, active, well-rewarded community based on compelled but seemingly sophisticated ignorance" (i.e., stockbrokers, stock analysts and other financial prognosticators). He adds, "...those...who tell of the future financial performance of an industry or firm, given the unpredictable but controlling influence of the larger economy, do not know and normally do not know that they do not know." (p. 40)

Finally there is the quaint fraud of the actions of the Federal Reserve Board, which Galbraith claims have no real effect on the economy.

Again, the blog being used as file cabinet. Sounds like a great book by one of my favorite people and a definite interlibrary loan candidate. A much better book than this snoozer or Joe the Plumber's new book unless he writes a sequel about how the government shouldn't pry into private business per his current lawsuit (dare we hope for a precedent?).

0 Comments:

Post a Comment

<< Home