The Bubble Mentality

Priming the markets for tomorrow's big crash

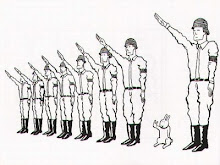

A financial bubble (I will use the familiar term “bubble” as a shorthand, but note that it confuses cause with effect. A better, if ungainly, descriptor would be “asset-price hyperinflation”—the huge spike in asset prices that results from a perverse self-reinforcing belief system, a fog that clouds the judgment of all but the most aware participants in the market. Asset hyperinflation starts at a certain stage of market development under just the right conditions. The bubble is the result of that financial madness, seen only when the fog rolls away) is a market aberration manufactured by government, finance, and industry, a shared speculative hallucination and then a crash, followed by depression.

Nowadays we barely pause between such bouts of insanity. The dot-com crash of the early 2000s should have been followed by decades of soul-searching; instead, even before the old bubble had fully deflated, a new mania began to take hold on the foundation of our long-standing American faith that the wide expansion of home ownership can produce social harmony and national economic well-being. Spurred by the actions of the Federal Reserve, financed by exotic credit derivatives and debt securitiztion, an already massive real estate sales-and-marketing program expanded to include the desperate issuance of mortgages to the poor and feckless, compounding their troubles and ours.

That the Internet and housing hyperinflations transpired within a period of ten years, each creating trillions of dollars in fake wealth, is, I believe, only the beginning. There will and must be many more such booms, for without them the economy of the United States can no longer function. The bubble cycle has replaced the business cycle.

If you want to skip reading the whole Harper's article, Eric Janszen says the next bubble will be alternative energy. I hope he is right and it is not food.

3 Comments:

At 9:32 AM, Anonymous said…

Anonymous said…

Fascinating insight, a truly interesting article. Let's all get into 'alternatives', everyone.

I remember learning about the South Sea Bubble in school. It took another twenty years before I really came to understand it. Economies have little to do with real money.

At 5:24 AM, ryk said…

ryk said…

Economies have little to do with real money.

That's well said, both figuratively and literally. Our current economic woes are a direct result of the government and citizenry spending scads of money that doesn't actually exist.

At 8:01 AM, United We Lay said…

United We Lay said…

My students have been asking to to explain this and I didn't really know how. Thanks for the help.

Post a Comment

<< Home